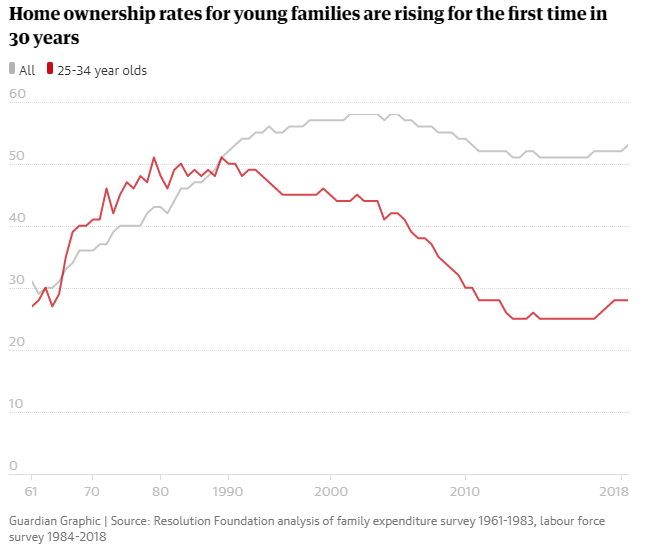

After a three-decade-long hiatus during which it became even harder for young families to purchase their own property, official statistics from the Resolution Foundation thinktank have shown that ownership rates amongst this group are now on the rise.

According to the thinktank statistics, 190,000 more young families became homeowners over the course of the past two years with the biggest increases observed in Yorkshire and the Humber, Scotland and the North West, where the proportion of young families who are homeowners has risen by between 4.6% and 8.4%. The thinktank calculated the figures from government surveys dating back to 1961.

The last 30 years have seen a downward trend in ownership rates among young families, due to a variety of factors, including changes in the property market and fiscal instabilities. During the 1980s, homeownership peaked at 51% in 1989; however, this figure had halved to only 25% by 2016 and now sits at its lowest level since at least 1961 (the earliest government survey). By the end of 2018, the downward trend was finally bucked, with rates of homeownership increasing to 28%, with the numbers also trending upwards as we move into 2019.

Resolution suggested that the changes in trend are down to differences in mortgage offerings over the past two years, with lower-deposit and more flexible offerings now available as well as the availability of larger mortgages. In addition to changes in lending habits, there is the relative slowdown in house price growth and stamp duty relief for first-time buyers, which have also aided those looking to join the property market.

Daniel Tomlinson, a research and policy analyst at Resolution, said: “Recent conditions in the housing market as we move away from the immediate aftermath of the financial crisis are finally helping more young families to buy a home of their own, but the long-term drivers of lower ownership rates are here to stay.”

For many young families, the opportunities now available to them to help them join the property market are now being made the most of, and therefore we are seeing the upward trend in ownership rates. A willingness to be more flexible in terms of their finances, as well as a willingness to move away from the bigger cities and in to more affordable areas, are helping this group to purchase a family home, however the Institute for Fiscal Studies commented this year that average house prices had risen around seven times faster than the average income in the last 20 years, showing that property ownership is still no mean feat.