|

Home ownership rates for young families on the rise

Welcome to our first newsletter of 2019! In this January edition, we look at why the rate of young families purchasing homes is on the rise.

We also provide some top tips to help you to spruce up your kitchen this spring, look at how quickly buyers can make a decision on a home, analyse how the property market fared in 2018 and finally, we explain the concept of shared ownership and why it might be a viable solution for those looking to purchase a home.

Home ownership rates for young families on the rise

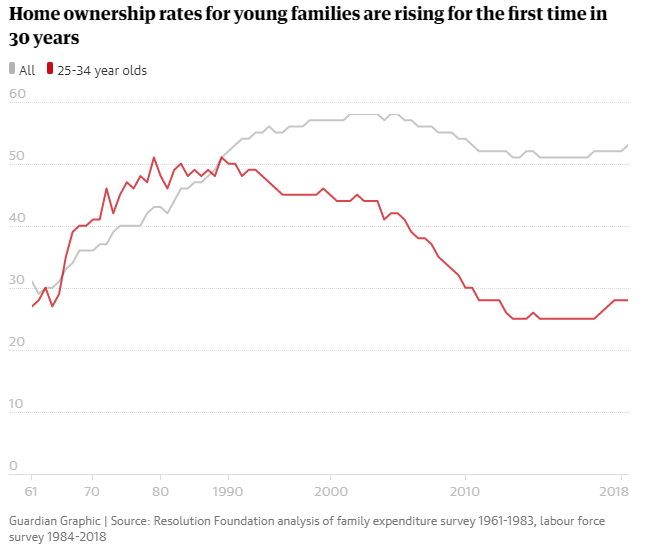

After a three-decade-long hiatus during which it became even harder for young families to purchase their own property, official statistics from the Resolution Foundation thinktank have shown that ownership rates amongst this group are now on the rise.

According to the thinktank statistics, 190,000 more young families became homeowners over the course of the past two years with the biggest increases observed in Yorkshire and the Humber, Scotland and the North West, where the proportion of young families who are homeowners has risen by between 4.6% and 8.4%. The thinktank calculated the figures from government surveys dating back to 1961.

The last 30 years have seen a downward trend in ownership rates among young families, due to a variety of factors, including changes in the property market and fiscal instabilities. During the 1980s, homeownership peaked at 51% in 1989; however, this figure had halved to only 25% by 2016 and now sits at its lowest level since at least 1961 (the earliest government survey). By the end of 2018, the downward trend was finally bucked, with rates of homeownership increasing to 28%, with the numbers also trending upwards as we move into 2019.

Resolution suggested that the changes in trend are down to differences in mortgage offerings over the past two years, with lower-deposit and more flexible offerings now available as well as the availability of larger mortgages. In addition to changes in lending habits, there is the relative slowdown in house price growth and stamp duty relief for first-time buyers, which have also aided those looking to join the property market.

Daniel Tomlinson, a research and policy analyst at Resolution, said: “Recent conditions in the housing market as we move away from the immediate aftermath of the financial crisis are finally helping more young families to buy a home of their own, but the long-term drivers of lower ownership rates are here to stay.”

For many young families, the opportunities now available to them to help them join the property market are now being made the most of, and therefore we are seeing the upward trend in ownership rates. A willingness to be more flexible in terms of their finances, as well as a willingness to move away from the bigger cities and in to more affordable areas, are helping this group to purchase a family home, however the Institute for Fiscal Studies commented this year that average house prices had risen around seven times faster than the average income in the last 20 years, showing that property ownership is still no mean feat.

Five top tips to help improve your kitchen

Whilst the living room is usually considered ‘the heart of any home’ in most UK households, the kitchen plays a much more central role in day-to-day family life. Follow these simple guidelines to achieve kitchen bliss!

Make the most of your space

Finding suitable storage units to house all of your pots and pans can be tricky - especially if you are working with a particularly small kitchen. Utensils, appliances, and accessories can certainly clutter up your worktops. Either tuck these items away in cabinets or display them in open shelving to add a decorative and homely feel.

If you are renovating your kitchen from scratch, choose cabinets that have pull-out baskets and drawers for maximum storage space. A recent trend for kitchen redesigns is to contrast worktop colours or textures and to change traditional handles for stylised ones. Although this look is popular right now, that may change by next year, and counters can be costly to modify. Finding a balance between trendy and timeless ensures that your kitchen never seems dated.

Go bold

Even if you’re not renovating your kitchen, there is no rule to say that you’re stuck with your old counters or the ones that a previous owner left behind. Sand and paint the counters yourself, and save having to buy and fit out a completely new kitchen every time you redecorate.

Whilst patterned tiles can make bold statements, don’t overwhelm your kitchen by tiling it from floor to ceiling. When going for bold, try to keep it simple. That may seem contradictory, but having too many bold prints, colours, or patterns in one room will make your kitchen look messy. Tie your room together with colour gradients and make complex patterns look a little subtler.

Lights, candles, atmosphere

Everyone appreciates privacy in their own homes, but rather than choosing to hang heavy curtains, look instead towards using a lighter fabric or blind to highlight any natural light in your kitchen. Likewise, a lighter colour will emphasise the openness of your window whereas a darker material may make the room seem much gloomier.

For the areas of your kitchen where natural light does not reach, put lamps or candles into position for ambience during the evenings. Spotlights or ‘downlights’ attached to the bottom of your cabinets are also an affordable way to improve lighting in your kitchen. These additions will make your room seem bigger, more open, and yet more intimate.

Opt for quirky and personal

Don’t be afraid to style your kitchen according to your own specific tastes, no matter how quirky they may be! By all means, consider hiding your knick-knacks when your property is on the market - as this will encourage potential buyers to envision buying your property - but whilst you are living there, live there! Whether you are a minimalist or a hoarder, showcase your treasures and memories for all to see.

Plants here, there, and everywhere

Having potted plants or herbs in your kitchen will give the room a healthy and natural look. Plant pots can be bought from a wide range of suppliers and you can even paint these for a different and unique finishing touch.

Your kitchen design ‘musts’ should be; appropriate use of space, maximum lighting options (both natural and artificial!) and suitable storing. Once you get these things right, they require very little attention. Unlike colour scheme and accessories, which can have a very dramatic impact and completely revitalise a room in need of some TLC.

It takes just eight minutes to decide on a property...

As any estate agent can tell you, a successful sale hinges on a good first impression. Prospective buyers possess a sixth sense when it comes to viewing a property and if things aren’t up to scratch – inside and out – you can guarantee they will spot it.

In fact, a recent study has revealed that the average house hunter only needs eight minutes to decide if a property is for them or not and six in ten adults will also choose not to buy a property based on the condition of the exterior of the property, without even needing to view the inside.

In comparison, 18% of buyers admitted to buying the very first property they view and 15% said they decided to buy the property before they had even viewed it in person.

This decisiveness extends online, with the average buyer spending eight minutes deciding whether or not to visit a property – highlighting the importance of a good online advert.

75% also confessed to being irritated upon finding that an advert or online listing does not accurately represent a property when visiting in person.

The study also revealed which aspects of a viewing signalled an early exit for many prospective buyers. The main offender was an obvious damp patch, which 60% of buyers said would put a stop to any future transaction, whilst a house on a main road or cracks in the wall would also put an end to the viewing.

For the buyers who are good at seeking out the problematic finer details of the property, there were some decisive reasons for buyers backing out of the viewing, such as dirty toilet pipes, overflowing bins, wheelie bins left in front of the property and faded or yellowed paintwork.

Some viewers take issue with a sellers lack of preparation for the viewing such as untidy rooms, poor DIY and ashtrays left around the house.

Other reasons included logistical problems such as the size of the rooms being too small for the buyer’s furniture or issues with the natural lighting of the property. The current owner’s furniture cluttering up the layout of a room which preventing the buyer’s imagination from running wild led to over a third of buyers to back out of a purchase.

The list showcases the importance of sprucing up your home, both before putting it on the market and before every viewing. A prospective buyer needs to weigh up the additional costs and work involved in buying a property, so ensure you give your home the most generic makeover possible and organise your possessions and furniture in a way that won’t distract the prospective buyer.

What did 2018 mean for the property market?

When we consider the course of 2018, be it in the context of the property market or not, there is one overriding theme: Brexit. The financial uncertainty which has been prevalent throughout the last twelve months has been a key factor in the ups and downs that the property market saw last year. However, despite the perceived gloom, there was still an increase in property transaction levels, showing the resilience of the market.

Brexit or bust?

The overarching concern last year was the uncertainty around Britain’s future with Europe, and how that may affect the financial stability of the United Kingdom. Whilst there were some who predicted that the mere discussion of Britain’s exit from Europe would reap disaster in the property market, the reality has been somewhat different. Overall, asking prices across the country rose by an average of just over 0.7% during 2018 which shows that, despite the difficult conditions, gains have been reported. In addition to the slight rise in asking prices, there was also an increase in the number of transactions throughout the year.

“Despite the current economic uncertainty, it’s encouraging to see that there is still some increase in transaction levels,” said Oliver Blake, the managing director of Your Move. Investors have similarly maintained their interest and faith in the UK property market with 63% of investors regarding property as a safe and secure investment over the course of 2018, according to a survey conducted by Market Financial Solutions.

Regional disparity

One major movement in the direction of the property market in 2018 was that of the emergence of regions outside of London in terms of property price growth. Traditionally, we have seen prices in the capital city increasing year-on-year; however, in 2018 it was Wales which returned the highest rise in asking prices at 6.2%, followed by the East Midlands at 5.1%. This strong growth in the regions has buoyed the property market in the UK overall, whilst market dormancy in London has offered a stellar opportunity for those looking to buy a home in the capital city.

Rental fundamentals

In the rental market, demand from tenants increased steadily with rental yields also proving resilient through the year. Increased demand in the student lettings market helped to support the rental sector, as well as changing demands from students – such as fast internet and private bathrooms – who are now more prepared than ever to spend high on their accommodation. Knight Frank, the estate agent, says it is currently marketing &1bn of stock in student accommodation and that the demand is ‘ten times’ the supply.

Finance

A key moment in 2018 was the decision from the Bank of England to raise the interest rate from 0.5% to 0.75%, the highest single increase seen since March 2009. This decision was taken as part of a plan from the Bank of England’s Governor, Mark Carney, to steadily increase rates in order to shore up the economy – with expectations of a strengthening economy, solid employment levels and more consumer spending all playing a part in the decision to raise rates. The interest rate rise took place in order to keep the rising cost of living under control. However, for borrowers, this increase had consequences such as on a &150,000 mortgage an additional &224 in annual cost.

Overall, 2018 has provided some extraordinary headlines for newsmakers who have reported on a regular basis that the impact of Brexit has been irreparable. However, despite pockets of stagnation in the property market and a rise in interest rates, 2018 has remained a stable year in the face of uncertainty.

Looking to 2019, there remains a level of uncertainty due to the political situation, yet forecasts for the market are expecting stable over spectacular for the year – nevertheless, there are many who are predicting a post-Brexit boom with buyers and sellers rushing to the market once the dreaded March 29th takes place.

Young people unaware of the possibility of shared ownership

With the wealth of options out there to help people onto the property market, it is no surprise that the number of first-time buyers has steadily been increasing, with numbers currently at an 11-year high. However, outside of the government’s Help to Buy scheme, it seems that young people do not understand their other purchasing options – chiefly that of shared ownership.

What is shared ownership?

Research carried out from YouGov found that although three-quarters of people in the UK have indeed heard of ‘shared ownership’, only 40% of 18 to 24-year olds were aware of the scheme. Furthermore, of that 40%, half of them revealed that they had no knowledge of shared ownership whatsoever, other than having heard of the name.

The scheme explained

Aimed mainly at first-time buyers, The Shared ownership scheme is a cross between buying and renting. Essentially, you buy a share of the home – between a quarter and three quarters – and rent the remainder at a reduced rate, with the option to buy a bigger share in the property at a later date. All shared ownership homes in England are offered on a leasehold basis, and the majority are newly built; however, there are some properties which are being re-sold by housing associations. At its core, the scheme is intended to help first-time buyers onto the market, but those who earn a household income (combined) of less than &80,000 or are renting a council/housing association property can also buy through the scheme.

A viable option?

Many of those questioned in the YouGov survey thought that shared ownership meant quite literally sharing the property purchase with friends, family or a partner. When the scheme had been properly explained, almost a quarter of the 18 to 24 year olds stated that they would be “very likely” or “fairly likely” to use the initiative in the future, the highest out of all of the age groups questioned – showing that the scheme appeals directly to the target market, with just the awareness of the scheme limiting participation numbers.

“Shared ownership as a method of purchasing has been around since the 1970s and offers a realistic way of getting onto the property ladder. It’s a proven formula that helps people secure a home, even where a traditional mortgage is not affordable, and its longevity is a testament to its success,” said Jaedon Green, director of product and distribution at Leeds Building Society.

“The method is becoming increasingly popular for first-time buyers as it reduces the need for a significant deposit, which can be difficult for some to manage. The scheme also permits first-time buyers to combine it with a Lifetime ISA, maximising any deposit,” he noted.

Awareness limiting efficacy

The YouGov research has shone a light on the fact that almost a quarter of those aged 24 or under would consider shared ownership as a way to purchase property, once they fully understood what the scheme consisted of. With so many potential buyers being put-off from buying a property simply due to lack of awareness it is clear that the onus is now on educating the wider public, and specifically 18 to 24 year olds, to the benefits of the scheme in order to continue to grow first-time buyer numbers and support the property market as a whole.

<< News

|

|