|

Busy Spring in store for the country's property market

We've plenty of news and guides for you this month!

We've got a heap of top decor ideas to help you to transform your home, we reveal what perks tenants are happy to pay a little more for and we've a step-by-step guide for those of you looking to purchase a property.

Not only that, there's plenty of good news for homebuyers as we slowly move into Spring; this season is set to be another busy one for the property market and there's also news on housing affordability the levels of active first-time buyers reaching their highest levels for a decade.

10 decor ideas to instantly transform your home

Now that spring is just around the corner, the much-welcomed extra sunshine might be shining a light on some of the less-polished parts of your property. If you’re thinking that a good spring clean won’t quite cut it this year, then follow our 10 home decoration ideas to instantly transform your home…

1) First impressions count

We all know that it is tough to change a first impression once it has been made, and the same is true for our properties. If you don’t have a grand entrance hallway, and even if you do, it is important to create the right aesthetic as soon as you step through the front door. Depending on the size of your entrance hallway, choose an appropriately-sized console table with a few choice ornaments and you’ll create an elegant first impression. A traditional table with some tasteful art above it will set a sophisticated tone, and an on-trend transparent table with high-gloss accessories will create a chic and modern atmosphere.

2) Mirror, mirror on the wall…

If you have a staircase in your home, it is easy to see it simply as a passageway to the next level of your home. Similarly, if you live in single-storey accommodation then you will most likely have a hallway that you see simply as a thoroughfare. Instead of treating these spaces as utilitarian, turn the walls into a gallery by hanging a variety of antique mirrors, an eclectic mix of photo frames or a mixture of both. Charity shops and antique shops are a great place to source interesting frames and mirrors, and as an added bonus, the reflective surfaces will help to brighten up the staircase or hallway.

3) Feng shui your home

When it comes to transforming your home, it’s not just a case of spending money – using what you already have in a different way can have equally stunning results. Rearranging your furniture is simple enough to carry out, but it can change a room entirely; throw the rule-book out of the window when you are experimenting with where to put your furniture and see what looks best. In the living room, for example, arrange your furniture around a coffee table rather than facing the television and you will create a much more social space.

4) Don’t neglect the accessories

One of the most cost-effective ways to update your home is through accessories; by simply enhancing what you already have through a few choice items you can take your home from drab to fab. Of course, the essentials of throw cushions, blankets and ornaments (such as candles and vases) are the holy trinity when it comes to jazzing up your room; however, you can also branch out to lampshades, wall hangings and art. By rotating your accessories seasonally, you will keep your rooms looking fresh, on-trend and reflecting the time of year.

5) Flower power

If you’re going to do one thing to your home in order to quickly refresh it, then adding flowers is a great idea. Placing some nicely arranged flowers in a clear glass vase will make any room feel more cared-for and elegant, all for only a few pounds!

6) Create a dreamy sleep-space

A good night’s sleep is essential for all of us, but the bedroom is often the last room that we renovate as it isn’t on show, like the living room or kitchen often is. Indulge yourself, and step-up your property’s style by investing in some bed linen. Plenty of cushions twinned with a matching throw at the foot of your bed will instantly make your bedroom feel more sumptuous, and you’re guaranteed to sleep soundly in your upgraded boudoir.

7) Don’t shrug from the rug

Floor coverings are costly and time-consuming to replace, so if you’re looking for a quick fix to update your home then we wouldn’t suggest laying a whole new floor. Something that will make a difference, however, is the use of rugs. A simple rug can change the whole aesthetic of your room, and the choices are endless; you can choose from boho, rustic or traditional and small, large, long or wide. Experiment by layering rugs and creating interest in your floor spaces without the expense of having to change the whole floor covering.

8) Curtains up

Curtains are more than a privacy aid, they can add colour, texture and interest not only to your windows but also throughout the home, if you are brave enough to use them creatively. Using curtains as an alternative to a door can add rich texture to your home and using a contrasting colour will make them pop against your walls.

9) Let there be light

Something that can make a room feel dark and dreary is a lack of light. If you want to transform your home, then changing the light fixtures, or adding in some extra lighting can make all the difference. Ensure that your ceiling lights aren’t dwarfed by heavy lampshades which are constricting the amount of light in the room – current trends favour glass lighting fixtures anyway, so changing your lampshade should be a simple fix. We’d also recommend adding in some uplighters and floor lamps to the corners of your room in order to avoid the wasted dark spaces which we are often guilty of neglecting.

10) Make a statement

If your walls are looking a little plain, or you’re simply looking for a way to brighten up the room then statement art is the answer. Easy to change and rotate with the seasons, statement art such as large-scale photography or something abstract will transform even the most listless room.

Busy Spring in store for the country's property market

Spring has always been a popular time of the year for buying and selling properties, with the change from the colder months of winter to the warmer spring temperatures often galvanizing people to make a change. This year is forecast to be no different and spring 2019 is set to be a busy time for estate agents across the UK…

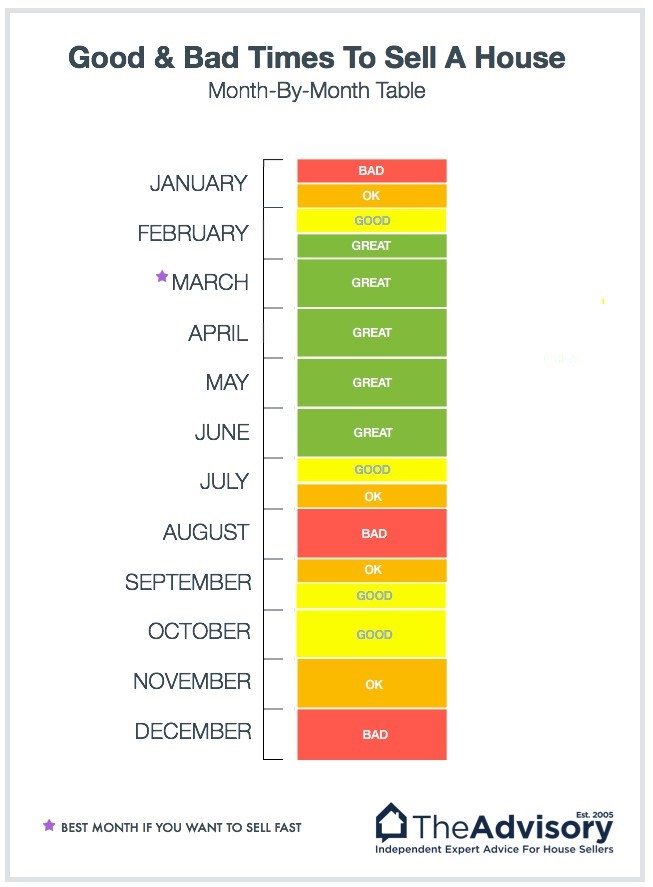

Recent analysis from The Advisory, an independent advice service for house sellers, has shown that March is statistically the best month to sell. The average amount of time taken to sell in March stands at 57 days, compared to other months later in the year at 79 days. With gardens starting to bloom, the weather becoming fairer and properties looking at their best, it is no surprise that spring is at the top of the list for when to sell a property.

Of course, spring 2019 is a little different than any of those prior due to the uncertainty that lies around Brexit. Although it may seem like the political climate could be a hindrance to property sales, there are many indicators which would suggest quite the opposite, with spring 2019 actually buoyed by Brexit.

There could indeed be somewhat of a surge after 29th March from potential buyers and sellers who have waited for the Brexit date to pass before they enter the market, and with supply and demand already at their highest levels for over a decade, this would see the property market in a particularly strong period.

Twinned with the historically low-interest rates, and the most flexible mortgage offerings ever provided by the banks, buying a property this spring will be on the minds of many and could indicate something of a renaissance for the property market, which has proven to be stable rather than spectacular in the last few months.

Buying a home is much more affordable than a decade ago

Buyer hesitancy has been a common theme over the last few years, with the affordability of housing, Brexit and a lack of confidence in the market frequently coming up as reasons for renters to stay put. It’s understandable that plenty of potential buyers are feeling a sense of unease when it comes to taking the plunge on a house, but the reality is that more and more people are putting their worries aside and searching for that perfect home, even within the current climate.

December saw a rise in mortgage approvals, for instance, and we now have more good news to share due to the fact that affordability is improving at its fastest rate since 2011, meaning that purchasing a home is more affordable than it was ten years ago.

According to mortgage broker Private Finance, the average borrower is saving £104 per month on what they would be paying in 2008, with average monthly payments falling from £804 to £700.

Whilst house prices have risen at a much quicker rate than wage growth-inflation over the last 20 years, the broker is insisting that once the initial payment is made on house, monthly repayments are broadly in line with the same levels seen 20 years ago.

“News of the UK property market’s affordability crisis is never far from the headlines,” offered Shaun Church, director at Private Finance. “What we often fail to acknowledge, however, is that thanks to falling rates, those with a mortgage today are in a similar – if not better – position than their predecessors, who owned property at a time when housing was considered vastly less expensive” explains Shaun Church, director at Private Finance.

“Homeownership can be attainable. Those in a position to buy should shop around for the best rates on the market, to ensure they capitalise on the incredibly competitive rates currently on offer. Borrowers should also consider locking into these with a longer fixed term, to cushion themselves against any further rate rises and keep the monthly cost of ownership low for as long as possible.”

First-time buyer activity at highest levels for over a decade

The number of first-time buyer mortgages has reached its highest level for 13 years, with some 370,000 new first-time buyer mortgages completed in 2018. Official trade body UK Finance has released data which shows that the highest number of first-time buyer mortgages since 2006 was reached last year, underlining the fiscal viability of purchasing a home for first-time buyers.

This consistent increase in the number of first-time buyers entering the property market can be seen as a result of; government schemes, greater mortgage availability and fewer rental properties on the market. Government policy has consistently targeted buyers who are keen to enter the property market primarily through their Help-to-Buy scheme and financial aid to first-time buyers, whilst competition amongst mortgage providers has brought a greater variety of finance options to the market. Amongst these mortgage varieties, we have seen more providers offering the 100% mortgage (or Loan-to-Value) and variations thereof, thereby opening up property to more people than ever before.

Richard Campo, managing director of Rose Capital Partners, said: “Lenders have been making it easy for first-time buyers over the last couple of months, with several providers announcing reduced rates on high loan-to-value mortgages.

“There are currently over 17,000 products available for first-time buyers.”

Twinned with the influx of mortgage varieties, and mortgages demanding a lower deposit value, is the reduced cost of these lower-deposit mortgages. The average two-year fixed rate LTV mortgage has fallen by over half a percent since last August, and big brands are also reflecting the consumer desire for LTV mortgages with Barclays, HSBC, Lloyds Bank, NatWest and Santander all cutting their rates.

Yopa chief property analyst Mike Scott agrees: “Since FTBs drive the whole housing market, allowing home movers to find a buyer and take the next step on the ladder, this is good news for the whole market,” he says.

In fact, the Halifax bank has recently found that first-time buyers are now so active in the marketplace that they make up the majority of home purchases bought with a mortgage in the United Kingdom. Based around the same UK Finance statistics, Halifax has found that the average price of a typical first home has jumped by 39%, from £153,030 in 2008 to £212,473 in 2018 with terraced houses and semi-detached remaining the most popular choices for first-time buyers.

Read our step-by-step guide to selling your property

Moving home is consistently included in the list of life’s most stressful activities, up there with marriage and starting a family. We like to make this process as simple as possible in order to keep the transition to your new home straightforward and enjoyable, so take a look through our guide and start your stress-free move with us…

1) Cash is king

First and foremost in our guide to selling is your finances – getting these in check will go a long way to smoothening out the whole process. Speak with your bank or mortgage provider to let them know your intention of moving in order to understand your financial position – for example, are there any charges for paying your mortgage back early? Of course, organising your new mortgage or understanding your options either with your current provider or elsewhere will put you in a good position when you are ready to move.

2) Don’t budge on the budget

Once you have understood your position with your current mortgage, it is important to consider what it will actually cost to sell your home and budget for this accordingly, in order to avoid any nasty surprises during the selling process. Of course, estate agency fees should also be budgeted for as these are the foundation to selling your current property, but don’t forget the EPC document which sets out the energy efficiency of your home which is a necessity for a seller to provide. There are also conveyancing fees for your solicitor or legal conveyancer, as well as removal costs – don’t forget to factor in how much it may cost to move your possessions.

3) Fail to prepare, prepare to fail

You have your financials in place, you know how much it is going to cost to sell your property, as well as what your mortgage options are moving forwards, so it is time to get hands-on with the property sale. Prepare your property for selling in order to encourage a quick sale will put you in a better position to make an offer of your own on a property. The premise is simple; allow others to imagine themselves in your home by decluttering and showing off the raw potential that your property can offer to them. By decluttering the surfaces and removing the majority of your personal items and mementos, a buyer will be able to imagine their own possessions in your home and therefore be more likely to purchase your property. If necessary, bite the bullet and make the bigger changes – a fresh lick of paint here and there, a tidy up of the garden or a new bathroom suite will all help you to sell more quickly.

4) List early

To avoid missing out on your dream property, get your house on the market as early as possible – sometimes this may seem like you’re listing too early, but don’t be afraid to take the plunge. Listing your properly early will also help to focus your mind on the fact that you have made the decision to sell, and encourage you to be active in your own property search.

5) List with us

Our experience in estate agency and commitment to customer service sets us apart from other agents in the area – if you are looking for a smooth selling process with dedicated professionals, then look no further.

6) Offers galore

Your estate agent is legally obliged to pass on all offers which are made on your property – even if they are unrealistic, so be prepared to receive lots of differing offers and don’t jump at the first one. If you aren’t happy with the offer, you can reject it outright or alternatively if you are pleased with the offer, you can accept it straight away. Between those two extremes, however, there lies much room for negotiation so think carefully about what you’re prepared to accept for your property, and how this will affect your own search for your next property.

7) Say “I do”

Once you have formally accepted an offer, your next move will be to remove your property from the market – often offers will be made with the caveat that your home will be immediately removed from the property market to avoid gazumping (a higher offer being later accepted). At this stage, a formal acceptance is not legally binding – it is simply an agreement so do not rest on your laurels that the buyer is 100% committed; this is where being organised and making the process swift will help to avoid any second-thoughts by the people in your purchasing chain.

8) Contract tact

So, you have accepted an offer on your property. The next stage will be negotiating a draft contract between yourself and your buyer to cover things such as; whether fixtures and fitting are included, if they would like to seek any discounts for anything which has come up in their survey of the property and how long the passage of time will be between exchange of contracts and completion dates. Once the minutiae have been agreed upon, it is time to make the whole process legally binding and exchange contracts – if you pull out after this point then the buyer will get their deposit back and you may well be sued. If this point has passed without a hitch, then congratulations – you have sold your property! Once the exchange of contract happens, you will then have an agreed number of days to move out of the property (agreed when drafting the contracts which have just been exchanged between you and your buyer).

9) Moving day

You can move out right up to your day of completion – we’d recommend not leaving it quite so late just in case there is a problem with the moving process, but you do have the option!

10) Done and dusted?

Completion is official when the property changes ownership (contracts signed and exchanged), payment for the property is accepted and the keys have been handed over. All of these final touches occur on a pre-agreed date to ensure that all parties are in accordance, and there is no break in the selling chain. On this day, the property deeds, as well as the money, are transferred between the legal teams for each party, who will then register the transfer of ownership with Land Registry. Once the money has been transferred to your legal team, they will pay off the mortgage and you will then only have their fees to cover in order to finish up your sale neatly.

What perks are tenants happy to pay a little more for?

When it comes to letting a property, most landlords would probably remain quite conservative in terms of perks included with the home to avoid pricing themselves out of the market.

Whilst the property will need to be competitively priced to get the most out of your investment, there are some perks that tenants are happy to pay a little extra for.

A new survey has questioned tenants in the UK on what features and extras they’d most like in their homes and how much they’d be willing to pay for them.

Unsurprisingly, one of the most popular choices for tenants was the inclusion of pets, with 28% of the 3,290 tenants surveyed, willing to pay an average of £24 a month to have their furry friends stay with them in rented accommodation. This figure only increases for the up-and-coming generation, with 31% of 18-35-year olds willing to pay an extra £25.55 a month.

Also high on the list of wants is high-speed internet, with 21% happy to pay £19 more a month for a home located in an area that has a strong internet speed, which is understandable with today’s world of smart gadgets and streaming.

In some rented spaces, a bit of greenery can go a long way. Properties that come with a garden, even a communal one, are in high demand with 32% of tenants willing to pay extra for a home that has access to an outdoor space. Gardens are even more valuable in some of the larger cities, as houses with gardens in the capital command up to 20% more when put up for sale.

Staying in shape is clearly a priority for a good proportion of renters today, as 41% of those surveyed said that they would be happy to pay up to £20 more a month for accommodation that comes with an on-site gym. This also means that if your buy-to-let property is located close to good leisure facilities, it could fetch a higher price.

It was also found that tenants are willing to pay more for cleaning services. There were reports last year that due to lack of time, half of millennials are paying a professional to keep their homes and 13% of participants in this survey said that they would pay an average of £28 a month more to free themselves of some of their weekly chores.

While some of these perks may not apply to every property, it is clear that landlords and developers should take a closer look at what their property has to offer, as your home may be in more demand than you think.

<< News

|

|